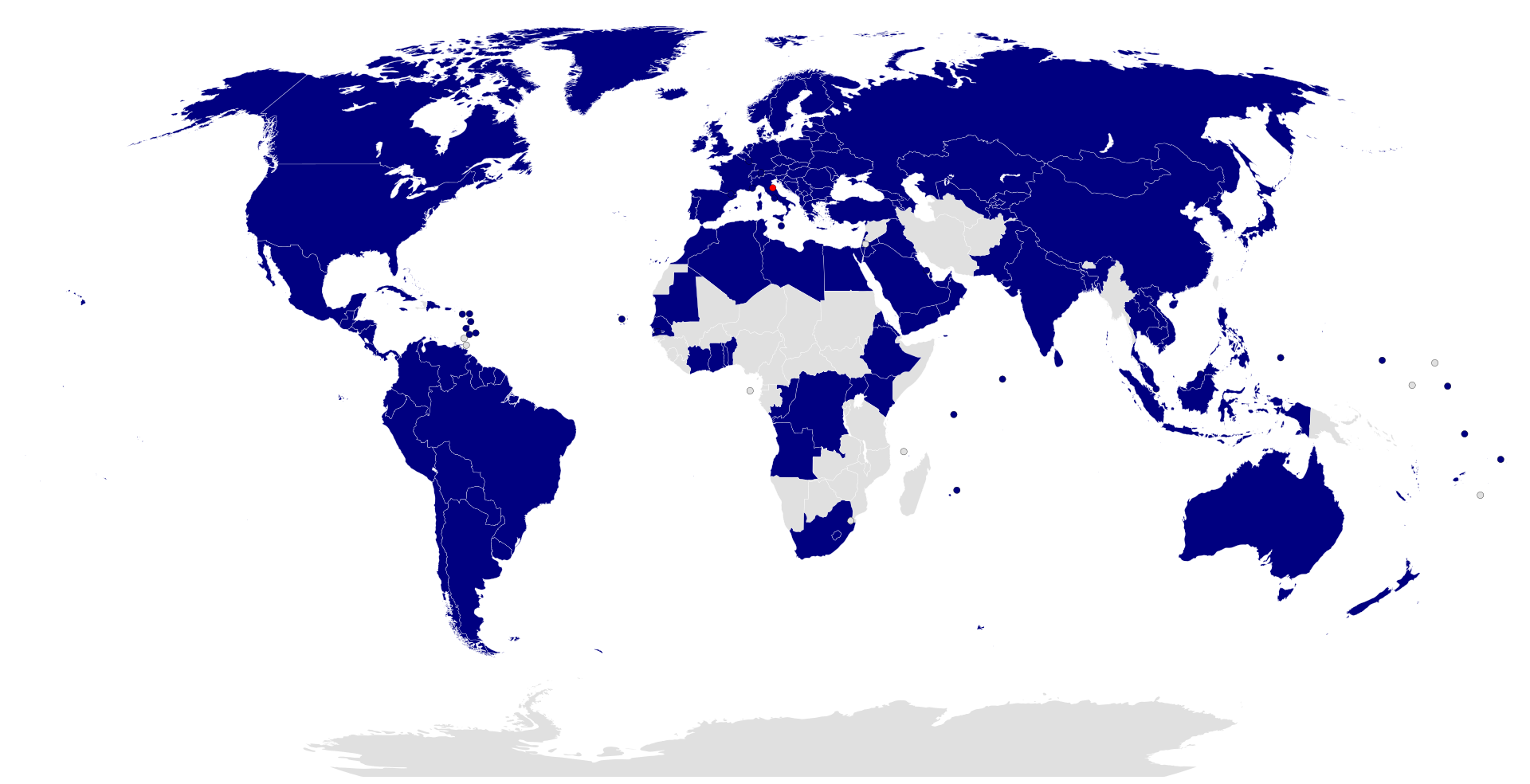

San Marino maintains official relations with 151 countries and is a member of major international organisations, including the UN and the Council of Europe.

Relations with the EU are based on a Cooperation and Customs Union Agreement, which has been in force since 2002. Under the new Monetary Agreement with the EU, which has been in force since 2012, San Marino is entitled to use the Euro as its official currency. San Marino was included in the Single Euro Payments Area (SEPA) in February 2014.

Negotiations are underway with the European Commission with a view to concluding an

Association Agreement that may allow greater integration in the Single Market and full equivalence of the citizens and enterprises of San Marino with the Member States.

San Marino has concluded numerous multilateral and bilateral agreements. Among economic, financial and tax agreements, particularly interesting are:

• 24 Double Taxation Agreements – DTAs (Austria, Azerbaijan, Barbados, Belgium, Croatia, Cyprus, Georgia, Greece, Hungary, Italy, Liechtenstein, Luxembourg, Malaysia, Malta, Portugal, Qatar, Romania, Saint Kitts and Nevis, Serbia, Seychelles, Singapore, United Arab Emirates, United Kingdom, Vietnam);

• 30 Tax Information Exchange Agreements (TIEAs) according to the OECD Model (Organisation for Economic Co-operation and Development);

• 8 Investment Promotion and Protection Agreements (Albania, Azerbaijan, Bosnia and Herzegovina, Bulgaria, Cyprus, Croatia, Malaysia, Ukraine).

In February 2019 San Marino obtained the highest OECD recognition (Compliant) for international tax cooperation and has been recognised as a “fully cooperative country for tax purposes” by ECOFIN. Such a decision was based on compliance with tax transparency and fair taxation criteria and with OECD measures.

In October 2015 San Marino signed with the United States of America the FATCA Intergovernmental Agreement (IGA-Model 2).

San Marino joined the Council of Europe’s Group of States against Corruption (GRECO) in August 2010.

Since 1998 it has been a member of Moneyval, the Committee of Experts of the Council of Europe for the evaluation of measures to combat money laundering and terrorist financing. It is also a whitelisted country, having implemented Directive 2005/60/EC, Directive 2015/849/EU (the so-called IV AML Directive) and the FATF methodology

(Financial Action Task Force), with constant revision of internal regulations in

order to bring them into line with the relevant standards.

In 1945, the Republic of San Marino adhered to the International Institute for the Unification of Private Law (UNIDROIT). Since 2015, San Marino law has provided that, if the parties expressly agree, contracts and contractual relations between San Marino and foreign entrepreneurs, or between foreign entrepreneurs are governed by the principles of international commercial contracts drawn up by the International Institute for the Unification of Private Law.

By virtue of its geographical position as an enclave of the Italian Republic, institutional, economic, social, and cultural relations with Italy have always been particularly important and strategic for San Marino.

The many bilateral agreements in force bear witness to the constant and excellent relations with Italy. Particularly significant are:

- Convention on Friendship and Good-Neighbourhood of 31 March 1939 and subsequent amendments, which still underpins the intense bilateral cooperation;

- Convention against double taxation of 21 March 2002 and its amending Protocol of 13 June 2012;

- Economic Cooperation Agreement of 31 March 2009, which covers several

- sectors.

San Marino has also implemented EU Regulation 2016/679 on the protection of personal data by passing Law no. 171/2018.